Should I Finance My Camper Or RV?

“Should I finance my camper or RV?” Isn’t quite the right question.

The better questions are, am I willing to pay the premium in the form of interest to get a camper or RV now? And does taking on debt make financial sense? These are difficult questions to answer because they are different for everyone. Hopefully, this article will give you some things to think about when considering a loan for an RV.

It is claimed that Albert Einstein once said, “That compounding interest is one of the most powerful forces on Earth.” Whether he said it or not the statement is very true. In the case of a loan, the force on interest is working against you. Even if it is a simple interest loan.

The short of it is this. A fairly average RV loan of 6% APR over a 10-year period will increase the amount you pay for your RV by 32%. That means for a $50,000 RV, you would pay a total of $66,000. When you get a loan, you pay a substantial amount extra for the convenience of getting your RV sooner.

RV loans

Most RV loans are going be simple interest loans basically you’re not going to pay interest on the interest only on the principle. Getting a simple interest loan can add thousands of dollars to the total cost of purchasing a camper. For example, on a $50,000 loan financed at 6% APR for 10 years, you will have a monthly payment of $555. By the end of the payments, you will end up paying well over $16,000 interest.

Taking that same loan and turning it into a 20-year loan the payments go down to $358 but the amount of interest paid more than doubles to almost $36,000. That is a lot of money and you may not be comfortable paying 20 to even 100% percent more than the sale price. If you aren’t, there are other options out there for you besides a loan.

Interest rates

RVs and campers are luxury items and generally have higher interest rates compared to cars. The current rates are ranging between 4% to 20% depending on the size of the loan, length of the loan, down payment and your credit rating. Searching online I found loans with terms as short as 1 year to as long as 20 years. The longer the loan the lower the monthly payment but you will pay considerably more in interest.

Besides having good credit, you can lower your interest rate by purchasing a new RV or a used one that is only one or two years old. Older RVs just like older cars are higher risk partly because more of the useful life has passed already.

Get a bigger RV to save on interest

While searching for the best option for us, we found that banks offered slightly better rates on loans over $10,000. In our situation, it was a 3% difference between a loan that was $1,000-$9,999 and a loan that was $10,000 or more. As a result, we would have had a higher monthly payment for a less expensive RV. A $10,000 loan at 9% is just under $127 per month, but a $9000 loan at 12% is about $129 per month. I know it’s not much but it could mean getting a few extras for the same monthly payment if you are close to the dollar threshold for a lower rate.

Loans over $50,000 had even lower rates. For my family and our budget, it meant that we could get a larger RV than we had anticipated, with more room for the family to spread out, and we could see ourselves using this RV as our children grew older. We purchased a 24-foot trailer versus a 19-foot trailer.

As you are making decisions about which camper to buy thinking about the pros and cons of the space and amenities you have and how that could affect your family in five years helps to determine another factor in how much you are willing to spend and finance if that is the route you choose.

Things change

Interest rates are subject to change, banking regulations, and the bank’s willingness to lend also affect rates. The banks have teams of actuaries that figure out the risks and costs of lending out money.

How to do the math

Those of us who are not actuaries can dig deep for some long-forgotten math class equations and our trusty graphing calculator from the junk drawer if you didn’t sell it or give it away after the last class. There is an easier option and download the “EZ Calculators” app on your smartphone. This is the calculator we used in my college finance classes.

EZ Calculators

The “EZ Calculators” has multiple financial calculators that can help you to understand how much a loan is going to cost. I use the automobile calculator and the home loan calculators within the app. The auto calculator has lines for trade-in value, taxes, and dealer fees. The home calculator has an amortization chart. The amortization chart will tell how much the payoff of the loan will be after you make the payment each month, allowing you to see how much principal remains on the loan.

This is where you can really see the effects of the interest on the loans. What is also interesting to experiment with is instead of going to Starbucks twice a week, put that $10 towards your loan and watch how you can save months of payments off your loan. The home loan calculator has spot for extra payments.

Deprecation and Loans

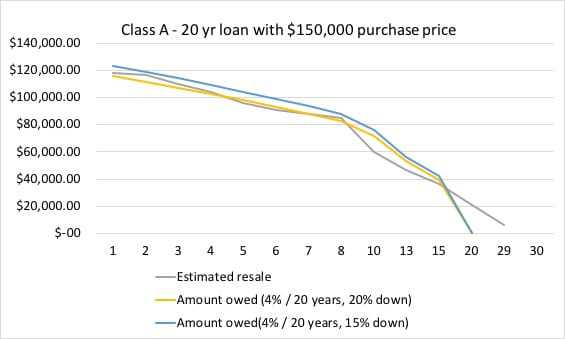

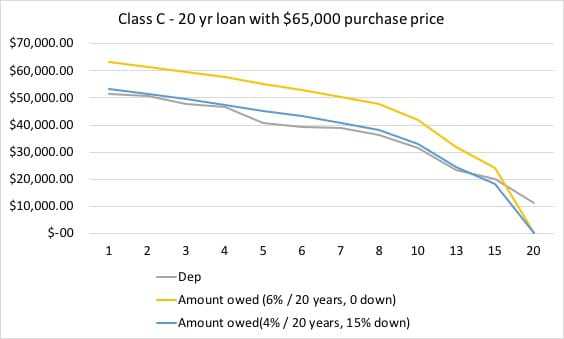

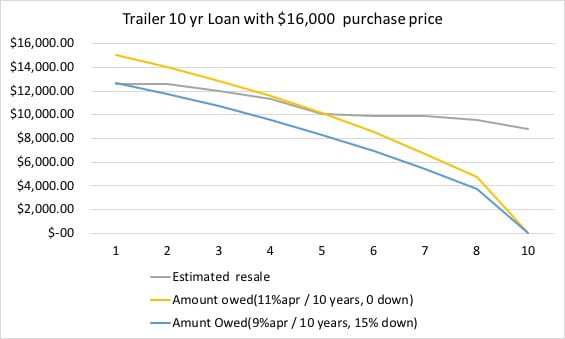

The moment you drive your new camper off the lot it begins losing value. See our article on depreciation to help you estimate just how much. A 20-year loan with little to no money down will put upside down on the loan for the life of the loan. Upside down means you owe more on the loan than the collateral (the RV) is worth.

Being upside down on a loan is a dangerous place to be. Everyone should remember the 2008 housing bubble. Being upside down on an RV loan means you can’t sell or trade it in without having to come up with the difference and depending on the loan it could be $1000s or tens of thousands of dollars.

Down Payments

When borrowing to purchase an RV put at least 15% down on loans 10 years or less and 20% or more for longer loans. Some banks may require this much. You’ll get the best interest with a down payment of 20% or more.

In the graphs below, the gray line is the estimated resale price of the RV or camper based on Camper Report research. The blue and yellow lines are the estimated loan balance at the end of the year. The bigger the down payment the better, less interest, less likely to end up upside down and in the end, you will receive a better interest rate.

Know before you go

If you are going to finance the purchase of an RV or Camper, get preapproved with your local bank or credit union before you go to the dealer. This will give you an idea of what interest rates you can get on your own and how that payment fits into your budget.

Dealer Financing

The dealer may have additional financing options with lower rates or longer terms and you choose what works best for you at the time of purchase. Having the “EZ Calculator” on your phone will allow you to do the calculations quickly and compare the loans.

Making a purchase as large as an RV is about information and the more information you have the better choices you can make. Understanding how the deprecation is going to affect the resale gives you an idea about how much your down payment needs to be.

Having the calculator app will tell you how much more a 10-year loan is going to cost you over a 7-year loan. So, when you are sitting in a salesman’s office and all he wants you to do is sign on the dotted line, you’ll be prepared with your own knowledge, your limits, and some quick math to know if the deal is good for you.

If you don’t want a loan you can save for it.

If you are considering purchasing a camper and are more patient than wealthy, save for it. A $10,000 loan financed for 5 years at 4% interest would have payment of about $185 per month. If you saved that same $185 you would be able to pay cash in 54 months (4 1/2 years) and save yourself over $1000 in interest.

If interest rates are at 8% the monthly payment goes to about $203 and it would take 49 months (just over 4 years) to save $10,000. In this case, paying cash saves you $2165 in interest. A financial adviser or planner could help with a savings plan and maybe even earn you some interest on the savings.

Start small

Buy a used tent camper that you can tow with the vehicle you already own. See our towing guide and start saving for your starter camper. You could then do a combination of saving a down payment and taking out a loan or save for the whole purchase.

Going full time

Maybe you are near retirement and have already saved up to purchase your dream $200,000, class A motorcoach with everything you ever wanted. If this is the case for you, work with a financial adviser because pulling out that much cash at one time could have tax implications which would make financing a better option. You wouldn’t want to have them take out an extra $20,000 for Uncle Sam if taking a short loan will save you money. Your investment could also be earning more than the interest you would be paying.

Another option would be selling your home and taking the money to buy an RV and hitting the road. If you are paying cash either from savings or from selling an asset like a home keep in mind that that RV is going to depreciate and will need to be replaced one day. So, start saving for the next one right away and you’ll be ready when that time comes. You’ll also be earning the interest this way instead of paying it.

Final thoughts on RV loans

Campers and RVs are big purchases and the money spent can well worth the memories that are made with them. They can also become a huge financial burden you don’t plan carefully. Getting a loan, using savings, or selling an asset is up to you and what makes the most sense for you. One test that I was told to give to every big financial decision is the “sleep at night test.” Are you going to sleep better having to make a monthly payment even if it going to cost more and have more cash in the bank or no loan and less cash?

I am not a financial planner or adviser this article is just intended to get you to think about the costs of financing and give you some tools to help with the planning. If you have additional financial questions and even if you don’t it would be wise to seek out a certified personal financial planner at your bank or credit union. Some employers may even offer something through an employee assistance program.

Working with a certified personal financial planner is particularly import to if you are making a lifestyle change like going to full time RVing in retirement. They will be the best ones to tell you if financing makes sense for you and if not, they can help with creating a savings plan to help you realize your dream, or we can all keep trying to win the lottery.